Blog

Family businesses STILL more trusted

In an era marked by corporate scandals and public mistrust, family businesses have emerged as beacons of trustworthiness in the business world. Unlike publicly owned entities, family-run enterprises often prioritize long-term success over short-term gains, making them reliable partners for customers, employees, and communities. As illustrated by the Australian 2018 Royal Commission into Misconduct in the Banking, Superannuation, and Financial Services Industry, which uncovered numerous examples of significant corporate misbehaviour (including charging fees for no service, selling insurance policies to dead people and flouting anti-terrorism laws), it’s one thing for an organisation to present itself to the public as “trustworthy” but another matter altogether when they are faced with the competing influence of protecting their share price or executive bonuses.

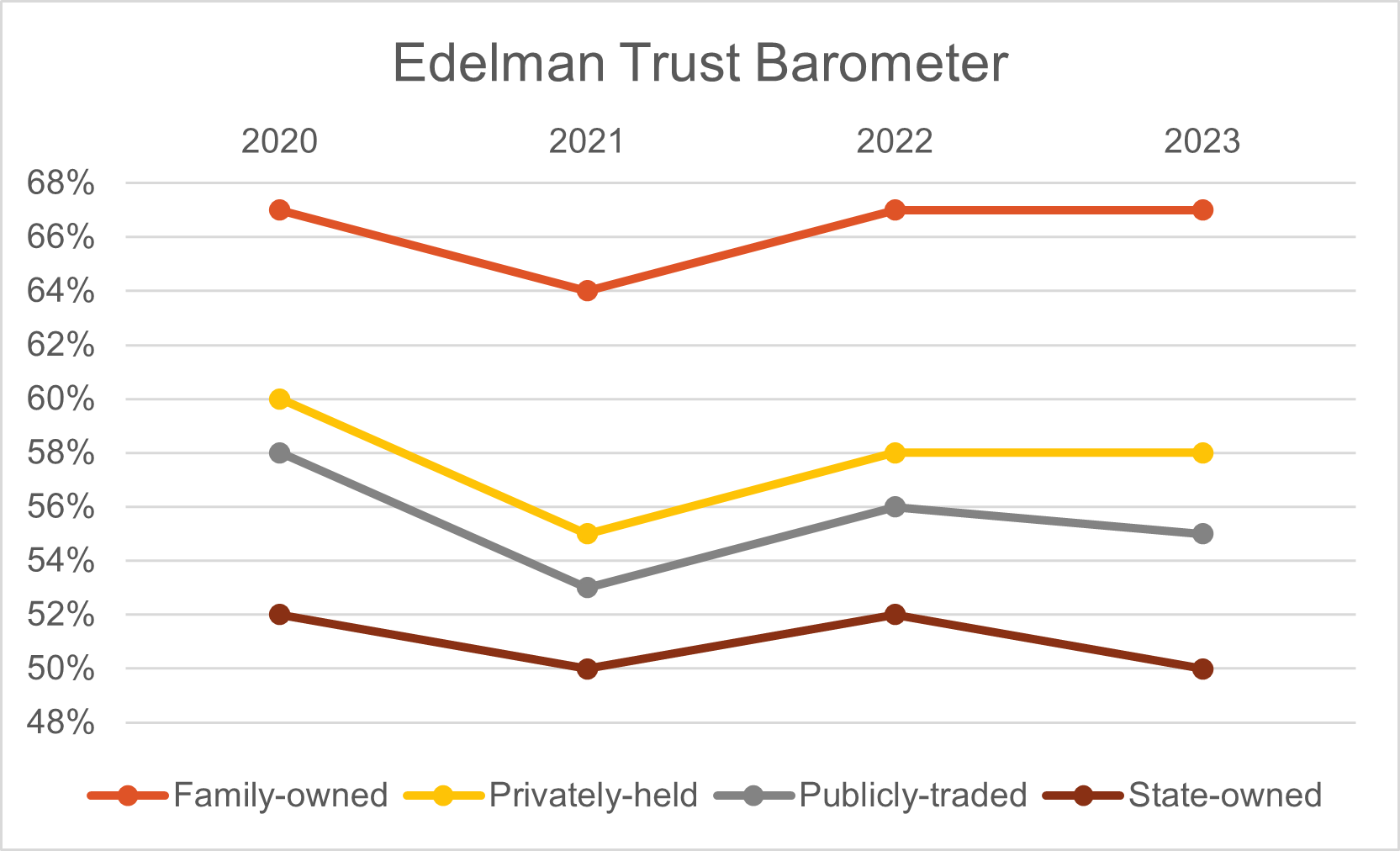

The global communications firm Edelman has for many years conducted an annual online survey which measures the degree of trust in family businesses, compared to other privately-held, publicly-traded and state-owned entities. This research encompasses more than 28 countries and over 32,000 respondents and asks the simple question: “how much do you trust an organisation to do what is right?” The recently-published Edelman Trust Barometer for 2023 shows that family businesses still enjoy a trust advantage far exceeding other organisation types, including a 12% trust advantage over publicly-traded entities and a 17% advantage over state-owned entities.

Trust in business is earned through consistent actions that align with stated values, rather than solely relying on slogans and advertising taglines. Building and maintaining trust requires ongoing efforts to prioritize transparency, ethical practices, and customer satisfaction. In a business landscape tainted by corporate disillusionment, family businesses stand out as trusted entities due to their commitment to core values, long-term perspective, and transparent practices, as opposed to prioritizing short-term gains over trust and integrity.

As consumers and investors increasingly seek ethical and trustworthy business partners, family businesses are continuing to guide the way towards a more responsible and sustainable future.

Robert Powell FCA GAICD is the founder and Managing Director of Family Boards Pty Limited, a specialist consultancy helping family companies achieve best practice in board governance and risk management. He an accredited specialist adviser member of Family Business Association (AU), a Graduate of the Australian Institute of Company Directors, and a Fellow of Chartered Accountants Australia and New Zealand.